Managing money isn’t about being restrictive—it’s about being intentional. Whether you’re trying to pay off debt, build savings, or simply take control of your finances, creating a monthly budget is your first step. But here’s the real challenge: how do you make a realistic monthly budget that doesn’t feel impossible to stick to?

The answer lies in building a system that works for your lifestyle, not against it. Let’s explore how to create a monthly budget that’s practical, personalized, and sustainable.

Understand Your Financial Reality

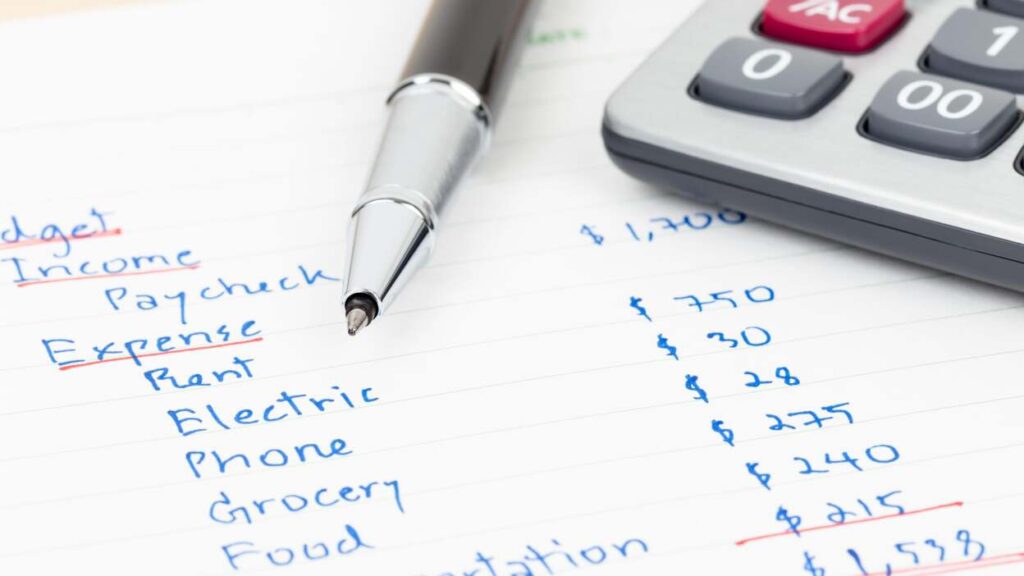

At Future Tech Informatics Blogs you’ll Learn How to Create a Monthly Budget? The foundation of any good budget starts with understanding what you’re working with. Begin by identifying your net income—the amount you take home after taxes and deductions. Include all reliable sources of income such as your salary, freelance gigs, rental income, or side hustles.

Once you know how much money is coming in, it’s time to examine where it’s going. Review your bank statements or use a budgeting app to track every expense from the past two or three months. Categorize your spending into fixed expenses (like rent, utilities, and loan payments) and variable expenses (like groceries, fuel, and entertainment).

Set Clear Financial Goals

Budgeting without goals is like driving without a destination. Do you want to build an emergency fund, pay off credit card debt, or save for a vacation? Define both your short-term goals (within the next 6–12 months) and long-term goals (such as retirement or buying a home).

Having clear goals keeps you motivated and focused. It also helps guide your spending decisions, making it easier to prioritize needs over wants.

Choose the Right Budgeting Method

The best budgeting method is the one you can actually follow. If you’re wondering, how do you make a realistic monthly budget, it starts with picking a framework that fits your habits and lifestyle. Here are a few proven methods:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

- Zero-Based Budgeting: Every dollar has a job, and your income minus expenses should equal zero.

- Envelope System: A cash-based system where you allocate funds into physical envelopes for each spending category.

Experiment to find what works for you—and don’t be afraid to mix methods.

Build and Balance Your Budget

Once you’ve chosen a method, start assigning dollar amounts to each category based on your income and goals. Be realistic. If your groceries usually cost $300 a month, don’t budget $150 just to save more—it won’t work in the long run.

Include a small “miscellaneous” category or emergency buffer to cover unexpected expenses. Life is unpredictable, and your budget should be flexible enough to absorb those little surprises.

Make Budgeting Easier with Automation

To make sticking to your budget easier and more consistent, automate as much of your financial system as possible. Set up automatic transfers to your savings account right after payday, schedule bill payments to avoid late fees, and consider using budgeting tools that sync with your bank accounts to track spending in real time. Automation reduces the mental load of money management and ensures that you consistently follow through on your financial goals—even when life gets busy.

Review and Adjust Monthly

Budgeting is not a one-time task—it’s an evolving process. At the end of each month, review your spending and compare it to your budget. What worked? What didn’t? Where did you overspend?

Make adjustments as needed. As your lifestyle or income changes, so should your budget. This habit ensures your financial plan stays both relevant and realistic.

Conclusion

So, how do you make a realistic monthly budget? The secret lies in understanding your income, tracking your spending, setting meaningful goals, and choosing a budgeting method that fits your life. Keep it flexible, stay consistent, and don’t be afraid to adjust along the way. A well-crafted budget isn’t about restriction—it’s about freedom and control over your financial future. For more Updates visit our Facebook Page.